Andersen Piterbarg Interest Rate Modeling Pdf Converter

- Andersen Piterbarg Interest Rate Modeling Pdf Converter 2017

- Vladimir V. Piterbarg

- Andersen Piterbarg Interest Rate Modeling Pdf Converter Pdf

Andersen and Piterbarg have written a Landau and Lifschitz of fixed income analytics.Alexander Lipton-Lifschitz, Co-Head of the Global Quantitative Group, Bank of America Merrill LynchThe authors bring a matchless combination of theoretical and practical expertise to these volumes. The result is a masterwork: truly insightful, inexhaustible in rigor, and terrifyingly complete in scope.Tom Hyer, Head of Quant Analytics, UBSWritten by two of the sharpest mathematical minds in the industry, the theoretical presentation is precise, the scope is comprehensive, and the implementation details reflect ample experience -Steven Shreve, Professor of Mathematics, Carnegie Mellon 作者简介. Piterbarg is a Managing Director and the Global Head of the Quantitative Analytics group at Barclays Capital, and has worked since 1997 as an interest rate quant at top investment banks. He taught at the University of Chicago Mathematical Finance program for a number of years, and is a prolific and respected researcher in the area of interest rate modeling.

Finance Training Course – Course Outline – Interest Rate Models: Forecasting Interest Rates and Application Published on January 8, 2011 August 6, 2012 by Jawwad Farid The workshop is aimed at treasury, risk and fixed income investors who use interest rate forecasting tools for arbitrage, ALM, risk or credit policy decisions. Linear Terminal Swap Rate. The idea presented in this section are from Andersen and Piterbarg,2010, Chapter 16. In the cash-settled generic formula, the part which is not directly dependent on Sis replaced. Andersen and V. Interest Rate Modeling Volume III: Products and Risk Manage-ment. Atlantic Financial Press, 2010.3. Foreign exchange (FX), and interest rates), I hope to have shown that whilst respecting the. AV11 Andersen, LBG and VV Piterbarg (2011). Interest Rate.

Andersen Piterbarg Interest Rate Modeling Pdf Converter 2017

Vladimir V. Piterbarg

Andersen Piterbarg Interest Rate Modeling Pdf Converter Pdf

He won Risk Magazine's 2006 Quant of the Year Award, and holds a PhD in Mathematics (Probability Theory) from the University of Southern California. He serves as an associate editor of the Journal of Computational Finance.Together with Leif B.G. Andersen, Vladimir V. Piterbarg is the author of the authoritative, 1,200 page long, three-volume set of books 'Interest Rate Modeling'. Full details of the monograph are available at www.andersen-piterbarg-book.com 目录.

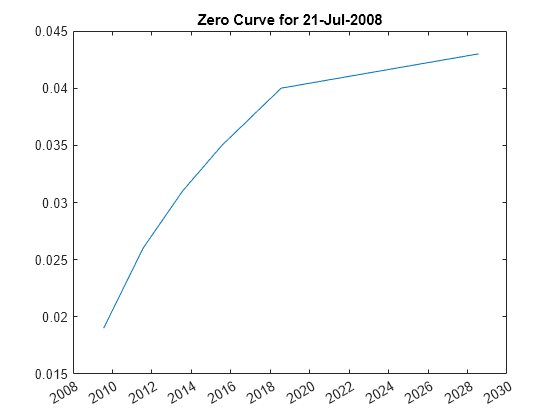

Academic Year2015/2016Learning outcomesThe course covers in detail the interest rate market and its evolution across the financial crisis. The modern interest rate modelling approach is developed to include funding and collateral, and applied to the most important interest rate derivatives. Market quotations for plain vanilla linear derivatives and options are used to bootstrap multiple-yield curves and volatility cubes. Interest rate models are introduced step by step with increasing complexity, including extensions to multiple-curves, negative rates, convexity adjustments and correlations.At the end of the course the students will know how the most important interest rates are fixed on the market, and how the modern interest modelling approach is extended to include funding and collateral. They will also understand the most important interest rate derivatives and their market quotations, and how to build the corresponding interest rate yield curves and volatility cubes. They will be able to model the term structure of interest rates using several approaches with increasing complexity, from the simplest Black model and its extension to stochastic volatility (SABR), to factor models for short rates (Heath-Jarrow-Morton, Vasicek, Hull-White) and forward rates (Libor Market Model), dealing with multiple-curves, negative rates and convexity adjustments. Practical examples and case studies will be illustrated using spreadsheet and codes.